Abstract

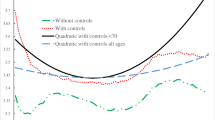

In a general-equilibrium OLG model with endogenous longevity, a political economy and a social planner solution are contrasted mainly with respect to public supplies of health care and environment protection. The latter is relatively more supported by the young because its beneficial effect on longevity takes more time to occur but then lasts longer; while the old relatively prefer health spending. With population aging, political claims for health care expenditure are self-reinforcing. This framework is able to generate a quite rich set of results. In the political economy larger health care/consumption and health care/environmental quality ratios are implemented. Changes in risk aversion, production pollution, health inputs’ elasticity of substitution may have opposite impacts across regimes. More complete annuity markets improve welfare. Further comparative statics is analyzed.

Similar content being viewed by others

Notes

Another difference is that in Jouvet et al. (2010) only the young do invest in health, whereas in our model health care expenditure is intended for the elderly people only. Both assumptions are extreme and made for analytical tractability as models work through simplifications; however, supporting health care provision is commonly one of the prior political items for retired and elderly voters.

Most of the literature features similar assumptions, but usually considers only one determinant of health (Chakraborty and Das 2005; Osang and Sarkar 2008; Bhattacharya and Qiao 2007; Kalemli-Ozcan et al. 2000; Fioroni 2010). A two-input longevity function is considered by Finlay (2006) and Leroux et al. (2011) who, in addition to health spending, have respectively a health base-level and an amount of genes, which are however exogenous in either model. With respect to health-spending, the same conditions given in the text are assumed.

See Chakraborty and Das (2005). In models with endogenous survival a cardinal assumption on the utility function is usually required since utility enters in level in the first order conditions with respect to the longevity inputs. As adding a positive constant to a utility function does not alter preference-ordering, this assumption does not seem restrictive.

Looking at π as the probability of surviving throughout the whole second period, there is a probability (1 − π) of un-enjoying savings.

A life annuity is an insurance product by which the insured person receives periodically a sum as long as she lives, in exchange for a premium charge. It allows agents to insure against the risk of outliving their savings, given the uncertainty of their remaining lifetime, by pooling the mortality risk across annuity purchasers. See Mitchell et al. (1999).

Every variable is expressed per young agent and the young cohort size is assumed to be constant.

This approach is the same as in John and Pecchenino (1994).

The lump-sum taxation scheme is preferred to a proportional tax rate for analytical tractability. With a proportional tax (shared between workers and capitalists according to their inputs’ shares) the dynamics of the model would become soon difficult to handle and the economic intuitions would be less clear, as expectations over future tax-rates would be involved. For the sake of simplicity, we abstract from the possibility that the government might run a deficit by issuing debt securities. The model’s taxation scheme keeps relatively simple the side of government’s revenues in order to focus on the expenditure side. Nevertheless, this scheme keeps nice properties: taxes are decided through voting, they can reflect intergenerational contrasts, they are more realistic than assuming only one tax as individuals’ contribution is usually different according to their age, they are consistent with the possibility of a negative lump-sum tax (i.e. an intergenerational transfer).

Hence, with respect to majority voting, probabilistic voting allows for a smoother aggregation of preferences and can be applied irrespectively of whether preferences are single-peaked or not. Moreover, majority voting in our framework would imply the implausible outcome of a “dictatorship” of the young, as they are homogeneous and in a greater amount than the old. Nevertheless, our setting can be adapted to a majority voting scheme by assuming that the relative preference for health care expenditure over environmental maintenance is continuously distributed across the population and increasing in age.

A parameter capturing exogenous political force for the old can be easily included in the model but it would complicate the storyline without adding substantial value or changing the qualitative results.

The number 2 in the square brackets on the r.h.s. of Eq. 19 refers to this double effect. It is a consequence of the fact that, since each elector has the same weight for the government, the political importance of the old increases with population aging.

Such a restriction is made in Chakraborty and Das (2005) as well. This has also the further implication that the savings function is increasing in the gross interest rate. However, in our framework, with no first-period consumption, this effect does not appear.

With such a technology, a corner solution with no maintenance cannot be excluded a priori.

See Brown (2001a) and Milevsky and Young (2007). The very low level of annuitised assets has been labeled as “annuity puzzle”. Possible explanations are the presence of bequest motives, adverse selection issues, risk pooling within family, high load factors by companies, presence of Social Security, inflation risk, ignorance and regulatory impediments (see Brown 2001a, b, Brown et al 2008). From a technical viewpoint, we could alternatively have obtained some simplifications by assuming the opposite case (γ = 1) which, however, would have been less realistic.

A simple way of introducing dynastic bequests in the model can be through a negative shift in γ.

This effect is partly contrasted by the one operating through α t and going in the opposite direction. In PE, indeed, the incentive to accumulate capital is reduced, as returns are decreasing and factors’ owners are remunerated according to the marginal productivity of their respective factor. This effect is taken into account by the government in the maximization problem.

Voluntary altruism can be introduced in the model either in the form of “joy-of-giving” (the old receive utility from intentionally giving the young part of their disposable income, which is thus available for capital accumulation) or in the form of care for next generation’s utility (the government at time t assigns a positive weight also to the generation which is old at time t + 2). In the former case, the optimization horizon of the political economy is substantially unaffected and there is no force leading toward the PL solution. In the latter case, the negative polluting effect of accumulating capital, and the long-lasting beneficial effect of improving environmental quality are taken into account like in PL (the PE first-order conditions are available from the authors upon request). However, the PE solution with intergenerational altruism still does not coincide with the PL outcome, as peculiar elements of PE are kept: e.g. the effect of population aging on generations’ political weight, the market constraints, the degree of completeness of annuity markets, etc. In particular, the result of Proposition 4 is confirmed.

While in PE it is necessary to introduce Assumption 1.5 to isolate k and m from the other equations of the steady-state system, this is not the case in PL.

The results concerning σ in Propositions 2, 3, 4 and 5 admit a similar economic interpretation also intending σ as a measure of consumption-smoothing propensity. Basically, when the preference for consumption smoothing is high, agents wish to enlarge their lifetime at price of lower consumption (Proposition 3); in PE this is mainly pursued by increasing health expenditure (Proposition 2), whereas in PL by environmental quality (Proposition 5); in PL, absent the political channel, the g/c ratio is relatively more sensitive to consumption-smoothing propensity than in PE (Proposition 4).

The specification in Eq. 45 implies that the mixed second derivative is positive, i.e.: h′′ g,E ≥ 0.

See Section 4.2 and footnote 17.

See Auerbach et al. (1992). All changes are slightly magnified but not reversed for larger γ.

When both k and m increase also the m − y ratio increases, because of more accentuated decreasing returns in production.

A positive effect of the degree of annuity markets completeness on steady state capital is found also by Ludwig and Vogel (2010).

See, for example, Schneider and Schneider (2006) who find empirical evidence that education is a central determinant of health relevant behavior.

References

Auerbach AJ, Kotlikoff LJ, Weil D (1992) The increasing annuitisation of the elderly - estimates and implications for intergenerational transfers, inequality, and national savings. Working Paper Series 4182, NBER

Bell M, Davis D (2001) Reassessment of the lethal London fog 1952: novel indicators of acute and chronic consequences of acute exposure to air pollution. Environ. Health Perspect. 109(S3):389–394

Bhattacharya J, Qiao X (2007) Public and private expenditures on health in a growth model. J Econ Dyn Control 31(8):2519–2535

Blackburn K, Cipriani GP (2002) A model of longevity, fertility and growth. J Econ Dyn Control 26(2):187–204

Blanchard OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93(2):223–47

Brown J (2001a) Are the elderly really over-annuitized? new evidence on life insurance and bequests. In: Themes in the economics of aging, NBER chapters, National Bureau of Economic Research, Inc, pp 91–126

Brown JR (2001b) Private pensions, mortality risk, and the decision to annuitize. J Public Econ 82(1):29–62

Brown JR, Wharshawsky MJ (2001) Longevity-insured retirement distributions from pensions plan: market and regulatory issues. Working Paper Series 8064, NBER

Brown JR, Kling JR, Mullainathan S, Wrobel MV (2008) Why don’t people insure late-life consumption? a framing explanation of the under-annuitization puzzle. Am Econ Rev 98(2):304–309

Browning M, Hansen L, Heckman JJ (1999) Micro data and general equilibrium models. In: Taylor J, Woodford M (eds) Handbook of macroeconomics, vol 1A, Elsevier Science, pp 19–40

Cervellati M, Sunde U (2005) Human capital formation, life expectancy, and the process of development. Am Econ Rev 95(5):1653–1672

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116(1):119–137

Chakraborty S, Das M (2005) Mortality, human capital and persistent inequality. J Econ Growth 10(2):159–192

de la Croix D, Doepke M (2009) To segregate or to integrate: education politics and democracy. Rev Econ Stud 76(2):597–628

de la Croix D, Licandro O (1999) Life expectancy and endogenous growth. Econ Lett 65(2):255–263

Diamond PA (1965) National debt in a neoclassical growth model. Am Econ Rev 55(5):1126–1150

Ehrlich I, Lui FT (1991) Intergenerational trade, longevity, and economic growth. J Polit Econ 99(5):1029–59

Evans MF, Smith VK (2005) Do new health conditions support mortality-air pollution effects? J Environ Econ Manage 50(3):496–518

Finlay J (2006) Endogenous longevity and economic growth. Australian National University, program on the Global Demography of Aging, Working Paper Series No.7

Fioroni T (2010) Child mortality and fertility: public vs private education. J Popul Econ 23(1):73–97

Galasso V, Profeta P (2004) Lessons for an ageing society: the political sustainability of social security systems. Econ Policy 19(38):63–115

Hazan M, Zoabi H (2006) Does longevity cause growth? a theoretical critique. J Econ Growth 11(4):363–376

John A, Pecchenino R (1994) An overlapping generations model of growth and the environment. Econ J 104(427):1393–1410

John A, Pecchenino R, Schimmelpfennig D, Schreft S (1995) Short-lived agents and the long-lived environment. J Public Econ 58(1):127–141

Jouvet PA (1998) Voluntary contributions with uncertainty: the environmental quality. Geneva Risk and Insurance Review (GRIR) 23(2):151–165

Jouvet PA, Pestieau P, Ponthière G (2010) Longevity and environmental quality in an olg model. J Econ 100(3):191–216

Kalemli-Ozcan S, Ryder HE, Weil DN (2000) Mortality decline, human capital investment, and economic growth. J Dev Econ 62(1):1–23

Katsouyanni K, Touloumi G, Spix C, Schwartz J, Balducci F, Medina S, Rossi G, Wojtyniak B, Sunyer J, Bacharova L, Schouten J, Ponka A, Anderson H (1997) Short term effects of ambient sulphur dioxide and particulate matter on mortality in 12 European cities: results from time series data from the aphea project. Br Med J 314(7095):1658–1663

Kunst A, Looman C, Mackenbach J (1993) Outdoor air temperature and mortality in the Netherlands: a time series analysis. Am J Epidemiol 137(3):331–341

Leroux ML, Pestieau P, Ponthiére G (2011) Optimal linear taxation under endogenous longevity. J Popul Econ 24(1):213–237

Ludwig A, Vogel E (2010) Mortality, fertility, education and capital accumulation in a simple olg economy. J Popul Econ 23(2):703–735

Mariani F, Pérez-Barahona A, Raffin N (2010) Life expectancy and the environment. J Econ Dyn Control 34(4):798–815

Milevsky MA, Young VR (2007) Annuitization and asset allocation. J Econ Dyn Control 31(9):3138–3177

Mitchell OS, Poterba JM, Warshawsky MJ, Brown JR (1999) New evidence on the money’s worth of individual annuities. Am Econ Rev 89(5):1299–1318

OECD (2005) Ageing populations: high time for action. Tech. rep., meeting of G8 Employment and Labour Ministers, London, 10-11 March 2005

Ono T (2003) Environmental tax policy and long-run economic growth. Jpn Econ Rev 54(2):203–217

Ono T (2005) The political economy of environmental taxes with an aging population. Environ Resour Econ 30(2):165–194

Ono T, Maeda Y (2001) Is aging harmful to the environment? Environ Resour Econ 20(2):113–127

Ono T, Maeda Y (2002) Sustainable development in an aging economy. Environ Dev Econ 7(1):9–22

Osang T, Sarkar J (2005) Endogenous mortality, human capital and endogenous growth. Departmental Working Papers 0511, Southern Methodist University, Department of Economics

Osang T, Sarkar J (2008) Endogenous mortality, human capital and economic growth. J Macroecon 30(4):1423–1445

Pautrel X (2008) Reconsidering the impact of the environment on long-run growth when pollution influences health and agents have a finite-lifetime. Environ Resour Econ 40(1):37–52

Pecchenino RA, Pollard PS (1997) The effects of annuities, bequests, and aging in an overlapping generations model of endogenous growth. Econ J 107(440):26–46

Pestieau P, Ponthière G, Sato M (2006) Longevity and pay-as-you-go pensions. CORE Discussion Papers 54, Université catholique de Louvain, Center for Operations Research and Econometrics (CORE)

Pope CA, Burnett RT, Thun MJ, Calle EE, Krewski D, Ito K, Thurston GD (2002) Lung cancer, cardiopulmonary mortality, and longterm exposure to fine particulate air pollution. J Am Med Assoc 287(9):1132–1141

Sartor F, Rondia D (1983) Hardness of municipal waters and cardiovascular mortality in four small Belgian towns. In: Abdulla M, Nair B (eds) International symposium. Health effects and interactions of essential and toxic elements. Lund, 13–18 June

Schneider U, Schneider BS (2006) The effects of education and working hours on health: a multivariate probit approach. SSRN eLibrary http://ssrn.com/paper=897727

World Bank (2007) World development indicators. Oxford University Press

Acknowledgements

A preliminary version of this paper was written during authors’ staying at the Université catholique de Louvain (Louvain La Neuve, Belgium). Carlotta Balestra acknowledges financial support from Chair Lhoist Berghmans and University of Bergamo. Davide Dottori acknowledges financial support from the Belgian French speaking community (Grant ARC 03/ 08-235 “New macroeconomic approaches to the development problem”), and Polytechnic University of Marche. The authors wish to thank two anonymous referees, Thierry Bréchet, David de la Croix and Frédéric Docquier for valuable comments, participants in the European Economic Association Annual Conference held in Barcelona in August 2009, Conference “From GDP to Well-Being. Economics on the road to sustainability” held in Ancona (Italy) in December 2009, BEED 2008 meeting held in Brussels in February 2008, AFSE conference held in Toulouse in June 2008, EAERE 16th Conference held in Gothenburg in June 2008, “Journées Générations Imbriquées, Développement et Dynamique Economique” meeting held in Aix-en-Provence in October 2008. All remaining errors are of course of the authors. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Banca d’Italia. The scientific responsibility is assumed by the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

The views expressed in this paper are those of the authors and do not necessarily reflect those of the Banca d’Italia.

Electronic supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Balestra, C., Dottori, D. Aging society, health and the environment. J Popul Econ 25, 1045–1076 (2012). https://doi.org/10.1007/s00148-011-0380-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-011-0380-x